Should I Buy Cash Car or Loan Car Malaysia

Straight up a car is never an investment. If you saved your money and prefer to own a car outright buying a car in cash could be right for you because you will be living within your means and saving money by not paying interest.

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

In case youre unsure an interest rate is a percentage charged by a lender in this case the bank you are borrowing from for use of their money.

. Then refinance house and put the money back in the bank. The salary is RM900 per month and 15 of the salary is RM135 per month. Weigh the risks and benefits as well as your personal preferences to make the right call for you.

If you want to invest buy property lah. Despite the rarity buying a car with an up-front one lump sum payment comes with its own set of perks for example bypassing a loan and its interest which is a win for you in the long-term. IINM interest would be much much lower.

The biggest upside of buying a car with cash is the money you will save on interest payments. If you are purchasing a 20000 car with 4000 down and an available APR of 5 over 48 months you will ultimately save close to 1700 in interest. Your monthly commitments include bank debts car loan credit card bills and personal loans and non-bank debt PTPTN loan etc.

It matters because if you default on your loan the car serves as a collateral. The only question is how much. This way you get spare cash.

As for the car suggestion Im not a fan of SUV so cannot suggest much maybe either Mazda CX-5 25ltr Honda CRV 24ltr or Nissan X-Trail 25ltr with the first 2 seem to be the most popular choice in Malaysia. However if youre buying second hand you may be able to make a cash payment. Car loans commonly offer a maximum margin of financing of 90 hence you are expected to pay 10 of the car value to the dealership.

We all know that cars are depreciating assets. You will avoid overspending. The maximum value of a car that can be purchased is RM 6750 based on the calculation of vehicle loans.

However when you finance a car its possible to obtain a car financing deal that could outweigh the benefit of paying for a car in cash with the added benefit of building your. This is probably the most important point to take note of because interest rates apply to ALL types of loans. Things you should know about hire purchase loans in Malaysia.

A brand new car can lose 15 to 30 of its resale value the second you drive it off the lot. You can buy under your name or also your wifes does not matter too. With the average cost of a used hatchback car in Malaysia ranging from at least RM23000 very few people fancy the idea or could afford to pay their car in cash.

You can buy a better car with a lower price tag. Pay a booking fee. This is not a problem for brand-new cars but becomes an issue when you try to finance a used car.

Now you know what those factors are and how to evaluate if investing is likely to provide profitable returns or not. But when buying a car be prepared to lose some money. Before we discuss more on the financing part let us go through the process required in order for you to purchase a new car or used car.

To buy a new car in Malaysia you will need to go through the following steps. If you purchase a car at the event you will also receive an additional year of free service loan interest rates as low as 168 same-day. Banks usually offer a maximum term of 9 years on the loan.

The question was whether he should use it all to buy a car cash and have no spare funds. No problem whatsoever for foreigners to buy cars either with cash or loans. Hence if youre planning a much bigger investment such as a house buying a used car is definitely the more sensible choice.

If the majority of your funds are sitting in a bank account abroad the best option is to transfer your money to Malaysia with Wise. Besides the financial credibility of yourself the value of the car also plays a big role in the loan approval. The refinance house thing is a proposed third option.

The answer to whether you should buy a car with cash or a loan depends on a number of factors. If you know that you only. Value of the Car.

This is a great reason to consider buying a car with cash if you are able. Buying a new car. TS already have 120k to buy the car cash.

If youre purchasing a higher-end vehicle youll likely want to investigate a car loan. If youre purchasing a higher-end vehicle youll likely want to investigate a car loan. But as per Tip 1 this does not take into consideration all expenses incurred when buying a car.

For example if you borrow RM100 from the bank and they charge a 2 interest rate you will have to pay the bank. If the majority of your funds are sitting in a bank account abroad the best option is to transfer your money to Malaysia with Wise. To lessen the amount of interest it is advised to pay a higher percentage upfront.

The figure below illustrates rough monthly expenses if we pay RM900 a. However if youre buying second hand you may be able to make a cash payment. Look for financing options CashPersonal loanHire purchase loan Prepare the necessary documentation.

Buy the car cash.

Here S How To Buy A Car In Malaysia Kwikcar Blog

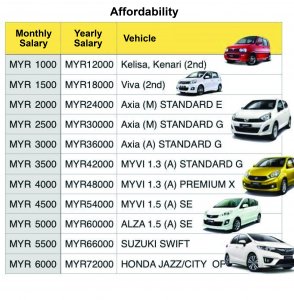

What Car Can I Afford To Buy In Malaysia Based On My Salary

5 Banks That Offer The Best Car Loan In Malaysia 2022

Should You Pay Back Your Car Loan Early

Land Rover Malaysia Ads Transport Land Rover Cars Land Land Rover Car

0 Response to "Should I Buy Cash Car or Loan Car Malaysia"

Post a Comment